📕 The Tech-Enablement Playbook for Healthcare Services Startups

How much impact does tech enablement really have on company value? Where do you choose to make software investments?

We serve on a board together and recently, while discussing ways to leverage new automation and AI tools, we found ourselves asking: How much impact does tech enablement really have on company value? Where do you choose to make software investments? We put together this piece in hopes that it helps founders answer those very questions.

Many digital health startups are, at their core, service companies. The care comes first—delivered by clinicians, coordinators, and coaches—and the technology is built around it. And when that technology is thoughtfully designed and tightly integrated, it becomes a lever for scale, efficiency, and better outcomes.

That’s the premise behind tech-enabled healthcare services (TEHS) companies. They occupy a unique (and increasingly valuable) middle ground between traditional healthcare services and pure software plays. Unlike conventional provider groups or care delivery models, which tend to be labor-intensive and operate on slim margins, TEHS companies use technology to amplify human care and drive down costs.

This is especially important as the U.S. continues to face deepening workforce shortages across both primary and specialty care. That labor gap strains health systems and threatens the affordability, availability, and consistency of care delivery.

Rather than trying to replace humans, TEHS companies build software that multiplies their impact. Smart triage tools, asynchronous communication pathways, automated follow-ups, and AI-supported enable each provider to manage more touchpoints without compromising care quality (and often while improving it).

Companies like Omada Health and Hinge Health, which both recently went public, are great examples. They blend tech-driven infrastructure with high-touch care teams, creating patient experiences that are seamless, proactive, and value-based. The software is embedded in operations, enabling better population health management, faster cycle times, and more personalized care at scale.

Historically, tech investors have steered clear of healthcare services, wary of regulation, low margins, and high operational complexity. But we see TEHS companies as a different category entirely. When you start from the reality of how healthcare actually operates—manual processes, fragmented systems, overloaded providers—the potential for transformation is enormous. We don’t view these companies as diluted versions of SaaS; we see them as next-generation healthcare delivery systems with tech as a multiplier. That’s the lens we’ve always applied, and it’s why we remain bullish on this model.

Here’s what we’ll cover in this piece:

Why tech-enablement is strategic

How tech shows up inside your company

Practical tips for climbing the tech stack

How to decide whether to build vs. buy

How tech-enablement shows up on your P&L

TEHS comps for your pitch deck

Why tech-enablement is strategic

At its core, tech is about making healthcare more efficient, more affordable, and more scalable. In a system historically bogged down by manual processes, fragmented data, and overwhelming administrative burden, thoughtful technology integration becomes a superpower.

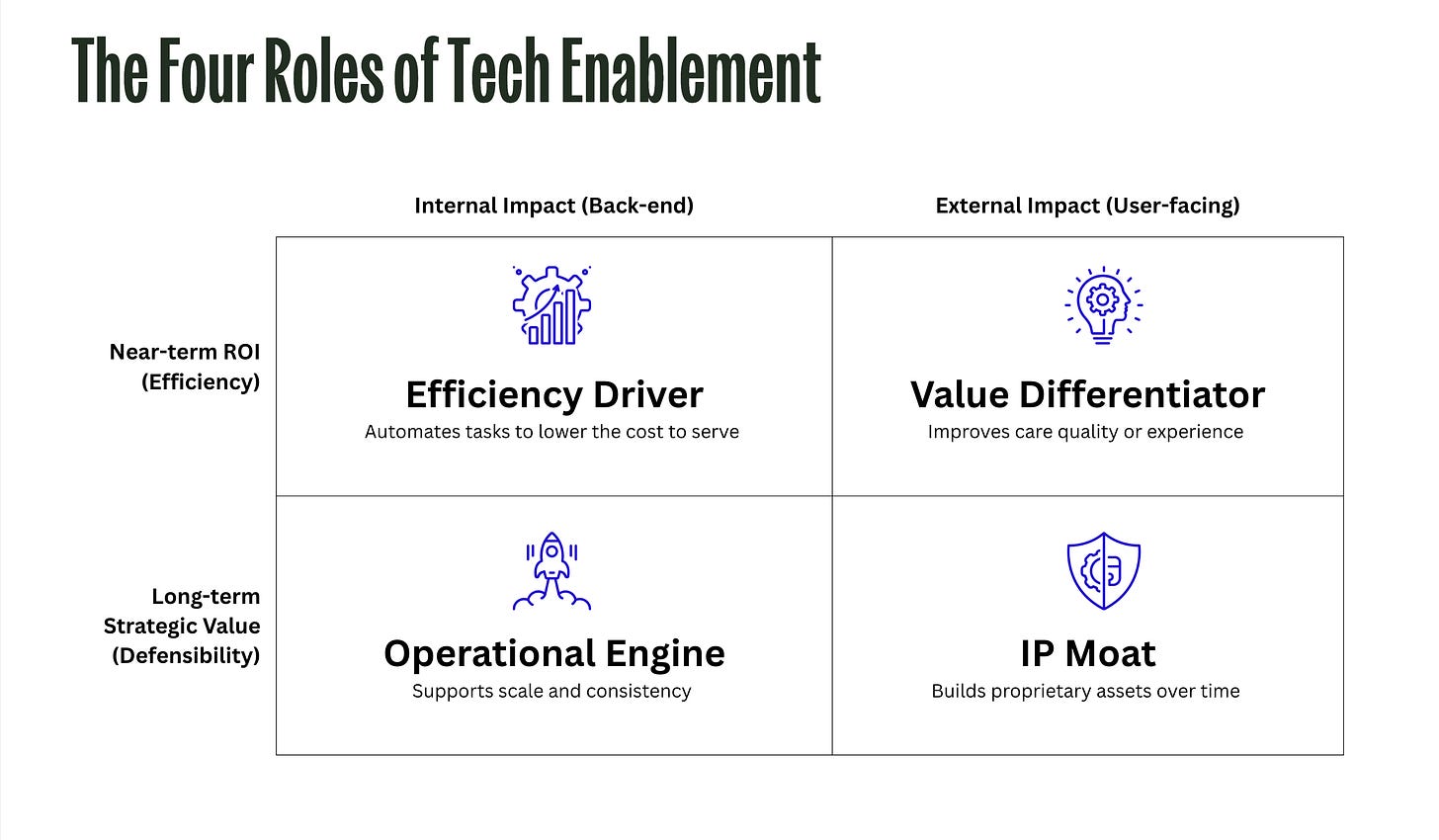

Tech can serve many roles in a healthcare services startup:

A value differentiator, helping you deliver smarter, faster, or more personalized care.

An efficiency driver, automating and improving low-complexity, repeatable tasks that once required armies of coordinators.

An operational engine, providing the behind-the-scenes infrastructure that keeps care delivery consistent and scalable.

An IP moat, where your proprietary technology or data systems become core to your defensibility, giving you tangible IP.

Every new feature should serve a strategic purpose and tie to a clear business outcome. You can’t manage what you don’t measure, and in a resource-constrained environment, every dollar spent on software is a dollar not spent on hiring, marketing, or patient care.

Tech investments should create measurable value for your business. Whether you aim to improve margins, enhance the patient experience, or build long-term defensibility, the goal is to ensure the return justifies the spend.

Value differentiators help you deliver better care, efficiency drivers cut costs and boost margins, operational engines lay the groundwork for scaling, and IP moats build long-term defensibility, thus increasing your enterprise value.

In every decision your dev team makes, ask:

What role is this technology playing?

What outcome should it drive?

How will I know if it’s working?

Answering those questions clearly and early can be the difference between tech as overhead and tech as strategy.

How tech shows up inside your company

So, what does tech-enablement look like in practice? Depending on your business model and stage, it can take different forms. But the throughline is the same: using software to extend your team's work without watering down the care.

Value Differentiators

Patient-facing tools (e.g. engagement, tracking, portals) → Enhance patient experience, accessibility, and personalization

Virtual care platforms → Enable seamless, modern care delivery on patients’ terms

Efficiency Drivers

Back-office automation (billing, prior auth, credentialing, compliance, scheduling) → Reduce administrative burden and accelerate reimbursement

Provider tools (AI scribes, workflow automation, smart routing) → Increase throughput and reduce clinician overhead

Funnel optimization tools (sign-up, onboarding, intake) → Improve conversion rates and lower CAC

Operational Engines

EHR systems and integrations → Ensure access to clinical data while minimizing duplicate work

Provider coordination → Streamline communication, handoffs, and task management to support consistent care delivery

Back-office operations (again) → Support scalable, reliable execution as your volume grows

IP Moats

Data analytics and AI infrastructure → Generate proprietary insights and long-term predictive capabilities

Connected devices (wearables, monitors, sensors) → Capture continuous, longitudinal data to build defensible infrastructure

Productized assets (e.g. internal platforms, care orchestration engines, workflow tools) → Create tangible IP that’s hard to replicate and strategically valuable to potential acquirers

Of course, you can integrate all of these things into your startup and still have a low-margin, unprofitable business. That’s because tech alone doesn’t make a business tech-enabled. It isn’t a check-the-box strategy. It is a means to the end, the end being efficiency, quality, and scale.

It only works if the software is driving real, measurable change—reducing the cost to serve, increasing throughput, tightening operations, or meaningfully improving outcomes. If your tools are layered on top of legacy workflows, difficult to use consistently, or adopted in isolation without changing the underlying process, you might just be adding cost and complexity.

Being tech-enabled means making deliberate choices about how software shapes your operating model and architecting your business around what those tools make possible.

Practical tips for climbing the tech stack

So, where do you invest first?

Start by anchoring your decision to one of the four goals: are you trying to drive efficiency, stand out from competitors, tighten internal operations, or build long-term defensibility? The right investment depends on what’s limiting your growth today—and where you’ll get the fastest return.

For most early-stage companies, the smartest place to start is with efficiency drivers and value differentiators. These are the tools and systems that either help your team do more with less (like automating intake, billing, or documentation) or help your product stand out in a crowded market (like delivering more personalized, proactive care). They typically offer the clearest near-term ROI through better margins, higher conversion rates, and stronger retention.

For example, if your customer acquisition cost (CAC) is really high or conversion rate lower than you want it to be, that’s a signal to invest in efficiency tools that reduce friction in your customer funnel, automate follow-ups, or surface the right information at the right time to help increase your conversion rate, without just throwing more dollars at marketing.

If you’re losing money on every customer, you’ll want to find tools to help reduce your cost to serve. This might include AI-powered documentation tools, claims scrubbing before submission, automated outreach, or smarter intake workflows—anything that reduces the amount of manual work per encounter and increases throughput without adding headcount.

Or if your net-promoter-score (NPS) needs a boost, it may be time to invest in improving the patient experience. What features are your customers begging for? Start there.

Once you’ve covered those basics, you can start building your operational engine—the behind-the-scenes tools that help your team run more efficiently, coordinate better, and avoid dropped balls as volume increases. Think routing rules, dashboards, escalation triggers, and team workflows that will help your company scale.

And while you’re thinking long-term, you may want to start planting the seeds for an IP moat. This could be as simple as collecting structured data or building tooling that surfaces patient-level insights no one else can access. We find this the most challenging area for TEHS companies to address. But efforts can compound into meaningful defensibility and enterprise value when done right.

Because IP moats and operational engines take longer to build and often don’t deliver immediate results, they’re often best tackled right after a fundraise, when you have the capital to invest ahead of ROI.

To figure out what kind of investment makes the most sense right now, ask yourself:

Where is your business bottlenecked—demand, capacity, or margin?

Are you losing money on each patient, or losing patients before they even start?

Is your team overwhelmed with repetitive work or coordination gaps?

Is your offering clearly better than the next best alternative?

The answers will point you toward the tech investment with the highest ROI for your current stage. That may evolve quickly, so revisit these questions often as your business grows.

How to decide whether to build vs. buy

“Buy first, build later” is the rule that will save you time, money, and headaches.

It’s never been easier to start a company, even in healthcare. What used to take a year and a dedicated engineering team can now be spun up in weeks using modular, third-party infrastructure.

Low-code/no-code APIs and platforms now handle everything from insurance verification to claims processing to full-service virtual clinics. That shift lowers the barrier to entry and accelerates iteration, but it also creates a new set of decisions about what’s worth building yourself.

Early in your journey, especially while you are still validating your care and operating model, lean on existing tools.

Use low-code platforms, open-source libraries, and APIs to prototype workflows in days or weeks.

Avoid full custom builds until you’ve proven the ROI. Building in-house is costly, time-consuming, and can lock you into assumptions before you truly understand the problem.

AI today is evolving fast. The highest-value use cases are still emerging, so rolling your own models prematurely usually wastes resources.

Of course, there are exceptions. If you have a genuinely unique need or access to proprietary data that demands a custom solution, then build. Or, if your technology is the product, then you can’t depend on third-party software.

But for most tech-enabled healthcare services (TEHS) companies, the service is the product. Patients aren’t buying software—they’re buying care that is accessible, responsive, coordinated, and trustworthy. The tech is invisible to them, and that’s the point.

Founders and product folks, we’d love to hear from you! What is your digital health tech stack? We’re compiling a list of the most useful building blocks for early-stage TEHS startups and would love your input. Drop your suggestions in the comments.👇

How tech-enablement shows up on your P&L

One of the simplest ways to see whether your tech is doing real work—or just adding overhead—is to look at the numbers. Specifically, your P&L will tell the story: how efficiently you serve patients, how scalable your team is, and whether your software is pulling its weight.

Start with gross margin. It’s a percentage that shows how efficiently you turn revenue into gross profit, calculated as:

👉 Gross Margin = (Revenue – Cost to Serve) ÷ Revenue

It reflects how much you keep after covering the direct costs of delivering care (which is likely mostly labor). It doesn’t include overhead like rent, marketing, or R&D—but it’s one of the clearest windows into operational leverage. For tech-enabled healthcare services (TEHS) companies, it’s the baseline test: are you building a better care model, or just a more expensive one?

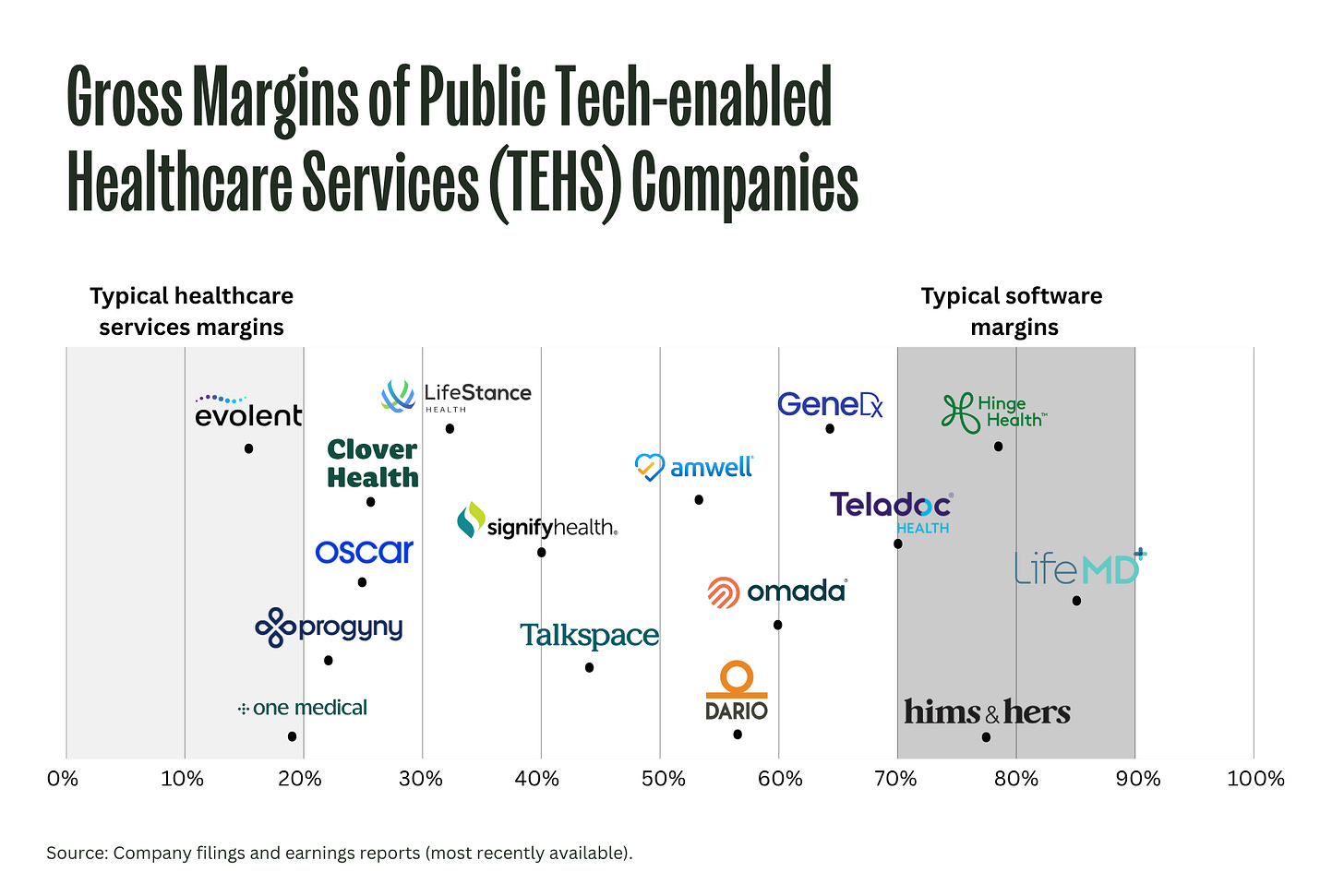

We looked at a range of public TEHS companies and mapped them by gross margin. Are they operating closer to traditional healthcare services—with sub-20% margins—or do they trend toward software companies, with 70–80%+ margins? Most fall somewhere in between.

(Note: Companies like Oscar and Clover, which operate as health plans, are a special case due to regulatory caps on profit.)

Gross margin matters because it’s tied directly to tech effectiveness. If it’s improving quarter over quarter, your automation tools, smart routing, or AI documentation assistants are probably reducing the cost to serve. If it’s flat, your tools might be underperforming—or going unused. And if it’s high but your patient outcomes are suffering, your model may not be sustainable.

Of course, gross margin isn’t a perfect metric. Some companies game it by reclassifying core delivery costs under G&A, or by outsourcing so much that they look efficient on paper but lose control of quality. Margin can also increase for the wrong reasons, like cutting corners on care. It’s a useful signal, but only when paired with context.

Even if you’re early, margin deserves your attention because it matters to everyone around the table. VCs use it to judge whether you're building a high-leverage tech platform or a people-heavy service that’s challenging to scale. Acquirers use it to forecast how quickly your model will pay off once integrated. Public market investors tend to reward high or improving margins with better EV/revenue multiples.

While gross margin is one of our favorite metrics, it’s definitely not the only number that matters. If you’re building a TEHS company, you’ll want to track a handful of other metrics that reflect scale, sustainability, and momentum of your tech-enablement efforts:

Together, these metrics give you a fuller picture of how your tech stack is driving performance. Track them. Share them. Use them to steer your roadmap. Investors do.

Comps for your pitch deck

Remember when we mentioned earlier that many tech investors have historically steered clear of healthcare services? Too operational. Too regulated. Too hard to scale.

You may still hear that today. But there’s a way to win them over: point to the exits.

Some of the biggest wins in digital health over the last decade have come from TEHS companies that pair strong care delivery with smart software. These aren’t “tech” companies, but they’ve commanded massive valuations because they solved real problems, operated with leverage, and scaled care models that worked. Simply put, they built businesses that the incubments want.

In addition to the publicly traded TEHS companies shared earlier, here are a few big exits worth pointing to in your pitch deck:

Oak Street Health – $11B (acquired by CVS Health)

Value-based primary care for Medicare patients, with centralized support and proprietary tech that scaled care delivery across hundreds of clinics.Signify Health – $8B (acquired by CVS)

Enabled in-home evaluations and care coordination using a national network of clinicians supported by data and logistics tech.One Medical – $3.9B (acquired by Amazon)

Membership-based primary care combining in-person clinics and virtual care, supported by a proprietary tech stack for better patient experience and streamlined operations.Landmark Health – $3.2B (acquired by Optum)

Delivered in-home medical care for complex patients, leveraging predictive analytics and logistics platforms to manage high-need populations at scale.CareBridge – $2.7B (acquired by Elevance Health)

Provided 24/7 care coordination and tech infrastructure for individuals in home and community-based settings, optimizing for both outcomes and cost.Iora Health – $2.1B (merged with One Medical)

Built a value-based primary care model serving the Medicare population with wraparound services and a purpose-built tech platform to support team-based care.MDLIVE – $2B (acquired by Cigna’s Evernorth)

Early leader in virtual urgent and behavioral health visits, with backend automation and clinician network management tools.AbleTo – $470M (acquired by Optum)

Behavioral health provider with a hybrid model and tech-driven matching and engagement tools to improve patient retention and outcomes.

What these companies have in common is clinical services paired with infrastructure that allowed them to scale faster and more efficiently than traditional care models. Their tech wasn’t the product, but it powered better margins, more predictable outcomes, and tighter operations.

Bringing it all together

For the many mission-driven healthcare founders we know, building a company often stems from a personal experience—waiting days for a postnatal follow-up, watching a loved one struggle with insurance red tape, or sitting in a clinic wrestling with paper forms.

We’ve watched founders pour enormous time and capital into workarounds for the bottlenecks and complexity that define our system (administrative costs alone consume about 25% of total U.S. healthcare spending). Today, we believe tech enablement represents the single biggest lever to make care more affordable, more scalable, and yes, more human.

Thoughtful tech should make things faster, more reliable, and easier to scale—without putting up more walls between patients and care. It should help the care team focus, operate with less friction, and deliver better outcomes across more lives.

Your choices around tech show up in the numbers. Whether that’s gross margin, revenue per employee, CAC/LTV, or how well your operations hold up under pressure, every tool you add should earn its place.

Start with what’s broken or slow. Fix what’s stealing your team’s time or preventing your service from standing out. As you scale, keep asking whether the software is doing real work, and measure its ROI.

The job of founders and operators isn’t to chase trends or pad the stack with unnecessary shiny objects. It’s to build companies that deliver care more effectively, serve patients more fully, and operate with greater resilience over time. That’s what the best tech enables—and why it matters more than ever.

Thank you to founders Thaddeus Fulford-Jones, Edrei Chua, and Lauren Makler for feedback on this piece.

I was cheering more or less all the way through your piece Halle :)

As we discussed on your Closing Time podcast as well (Jan '24), as the founder of Awell I've seen too many early stage startups look at our platform, thinking they need to build rather than buy, only to see them spend millions of VC capital on infrastructure that won't create any differentiating value.

One statement from the piece I would disagree with - "Buy now, Build later": if you humor the analogy, no one these days should consider first running in the cloud and then building their own cloud. For certain types of software (especially if it sits down in the stack, close to the bare metal infra) there might never be a need to build. The main differentiator is close to the end user: patient and care team - but you make that point yourself.

Halle, love this piece. The tech isn’t the product, care is framing is spot on. Most folks get lost chasing AI instead of asking the boring but essential question: does this help us serve more patients and create meaningful outcomes? If not, it’s just overhead in disguise. Appreciate the clarity here. More founders need to read this before writing a single line of code.